The Full Guide to Order Cryptocurrencies in 2024: Tips and Ideal Practices

The Full Guide to Order Cryptocurrencies in 2024: Tips and Ideal Practices

Blog Article

Exploring the Conveniences and Threats of Buying Cryptocurrencies

The landscape of copyright financial investment is characterized by an intricate interplay of compelling advantages and considerable dangers. While the allure of high returns and portfolio diversity is attracting, prospective investors have to browse fundamental challenges such as market volatility and regulatory uncertainties. Comprehending these characteristics is important for any person considering entry right into this unstable field. As we additionally analyze the subtleties of copyright financial investment, it becomes obvious that educated decision-making is paramount; nonetheless, the question remains: Just how can capitalists effectively balance these benefits and risks to safeguard their monetary futures?

Comprehending copyright Essentials

As the digital landscape develops, understanding the essentials of copyright comes to be vital for potential financiers. copyright is a kind of digital or online currency that uses cryptography for security, making it tough to copyright or double-spend. The decentralized nature of cryptocurrencies, generally built on blockchain modern technology, boosts their protection and transparency, as deals are recorded throughout a dispersed journal.

Bitcoin, developed in 2009, is the first and most well-known copyright, yet hundreds of choices, called altcoins, have actually emerged given that then, each with one-of-a-kind attributes and objectives. Financiers should acquaint themselves with key concepts, consisting of wallets, which keep private and public tricks needed for deals, and exchanges, where cryptocurrencies can be gotten, sold, or traded.

In addition, comprehending the volatility related to copyright markets is critical, as costs can change dramatically within short periods. Regulatory considerations also play a significant duty, as different nations have differing stances on copyright, influencing its usage and approval. By comprehending these foundational elements, prospective financiers can make informed decisions as they browse the complex world of cryptocurrencies.

Secret Advantages of copyright Investment

Spending in cryptocurrencies offers numerous compelling advantages that can draw in both newbie and experienced financiers alike. Among the key benefits is the potential for substantial returns. Historically, cryptocurrencies have actually shown remarkable cost appreciation, with very early adopters of possessions like Bitcoin and Ethereum realizing significant gains.

Another secret benefit is the diversity opportunity that cryptocurrencies offer. As a non-correlated asset course, cryptocurrencies can act as a hedge versus traditional market volatility, allowing financiers to spread their risks across various investment cars. This diversity can boost total portfolio efficiency.

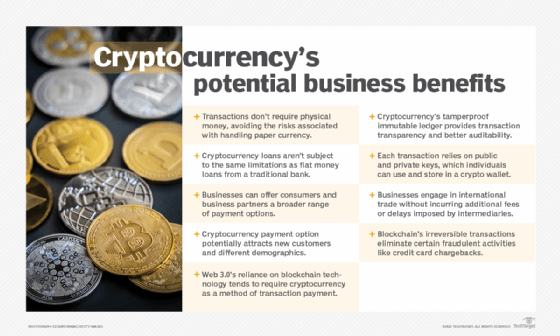

Moreover, the decentralized nature of cryptocurrencies uses a level of autonomy and control over one's properties that is commonly doing not have in traditional money. Investors can manage their holdings without middlemans, potentially minimizing fees and enhancing openness.

Additionally, the growing acceptance of cryptocurrencies in mainstream money and business even more solidifies their value proposition. Numerous services now approve copyright payments, leading the way for wider adoption.

Finally, the technical innovation underlying cryptocurrencies, such as blockchain, offers opportunities for investment in emerging fields, including decentralized money (DeFi) and non-fungible tokens (NFTs), improving the financial investment landscape.

Major Risks to Think About

One more vital threat is regulatory unpredictability. Governments all over the world are still formulating policies pertaining to cryptocurrencies, and adjustments in laws can considerably impact market characteristics - order cryptocurrencies. A negative regulative environment can restrict trading or also result in the prohibiting of certain cryptocurrencies

Protection risks also posture a considerable risk. Unlike typical financial systems, cryptocurrencies are at risk to hacking and fraudulence. Financier losses can take place if exchanges are hacked or if private keys are compromised.

Finally, the absence of consumer securities in the copyright space can leave capitalists prone - order cryptocurrencies. With minimal choice in the occasion of fraud or burglary, individuals may discover it challenging to recuperate lost funds

In light of these dangers, comprehensive research study and danger assessment are important prior to taking part in copyright investments.

Approaches for Successful Investing

Creating a durable method is essential for navigating the complexities of copyright financial investment. Capitalists ought to start by carrying out comprehensive study to recognize the underlying modern technologies and market dynamics of various cryptocurrencies. This includes staying educated about trends, regulative advancements, and market belief, which can substantially affect asset efficiency.

Diversification is another crucial strategy. By spreading financial investments across multiple cryptocurrencies, capitalists can reduce dangers related to volatility in any type of solitary asset. A healthy portfolio can provide a barrier versus market changes while improving the possibility for returns.

Setting clear financial investment objectives is important - order cryptocurrencies. Whether going for temporary gains or long-term wide range build-up, defining particular goals helps in making informed decisions. Implementing stop-loss orders can also safeguard investments from substantial slumps, allowing for a disciplined exit approach

Finally, continual surveillance and reassessment of the investment technique is crucial. The copyright landscape is dynamic, and consistently assessing efficiency against market conditions makes sure that investors click to read more continue to be active and receptive. By adhering to these techniques, capitalists can improve their possibilities of success in the ever-evolving world of copyright.

Future Trends in copyright

As investors improve their techniques, understanding future trends in copyright becomes progressively essential. The landscape of digital money is advancing swiftly, affected by technological innovations, regulative developments, and changing market characteristics. One considerable fad is the increase of decentralized finance (DeFi), which intends to recreate standard monetary systems using blockchain innovation. DeFi procedures are acquiring traction, offering cutting-edge monetary items that might improve exactly how people engage with their assets.

An additional arising pattern is the expanding institutional interest in cryptocurrencies. As companies and banks embrace digital currencies, mainstream approval is likely to enhance, possibly causing better price security and liquidity. Furthermore, the combination of blockchain technology right into various markets tips at a future where cryptocurrencies act as a backbone for transactions across fields.

Moreover, the regulatory landscape is developing, with federal governments seeking to develop structures that stabilize technology and customer defense. This governing clarity could cultivate a more secure try this website investment setting. Developments in scalability and energy-efficient agreement devices will deal with problems bordering transaction rate and ecological effect, making cryptocurrencies a lot more sensible for daily usage. Comprehending these patterns will certainly be essential for financiers seeking to navigate the intricacies of the copyright market successfully.

Conclusion

Report this page